Facts About Clark Wealth Partners Revealed

Wiki Article

Little Known Facts About Clark Wealth Partners.

Table of ContentsThings about Clark Wealth Partners9 Simple Techniques For Clark Wealth PartnersThe Facts About Clark Wealth Partners UncoveredSome Ideas on Clark Wealth Partners You Should KnowAll about Clark Wealth Partners

Merely put, Financial Advisors can handle part of the duty of rowing the watercraft that is your financial future. A Financial Consultant need to function with you, not for you. In doing so, they ought to function as a Fiduciary by placing the ideal interests of their clients above their own and acting in great belief while giving all pertinent facts and avoiding conflicts of rate of interest.Not all partnerships are effective ones. Possible downsides of functioning with a Financial Expert consist of costs/fees, top quality, and possible desertion.

Genuinely, the objective ought to be to seem like the recommendations and service received are worth more than the prices of the partnership. If this is not the instance, then it is a negative and thus time to reconsider the relationship. Cons: Top Quality Not all Monetary Advisors are equivalent. Equally as, not one expert is excellent for each potential client.

Clark Wealth Partners for Beginners

A customer should always have the ability to answer "what occurs if something takes place to my Financial Advisor?". It begins with due persistance. Always effectively vet any kind of Financial Advisor you are considering dealing with. Do not rely on ads, honors, credentials, and/or recommendations only when seeking a connection. These methods can be used to limit the swimming pool no question, however after that gloves need to be placed on for the remainder of the work.when interviewing consultants. If a details location of know-how is required, such as functioning with exec compensation strategies or establishing retirement plans for small company owners, discover consultants to interview who have experience in those fields. As soon as a relationship begins, remain spent in the relationship. Dealing with an Economic Expert should be a partnership - civilian retirement planning.

It is this sort of effort, both at the start and through the partnership, which will aid highlight the advantages and with any luck lessen the drawbacks. Do not hesitate to "swipe left" a lot of times before you finally "swipe right" and make a strong connection. There will certainly be an expense. The role of a Monetary Advisor is to aid clients establish a plan to meet the economic goals.

That job consists of fees, in some cases in the forms of asset administration fees, payments, planning charges, financial investment item charges, and so on - Tax planning in ofallon il. It is necessary to comprehend all costs and the framework in which the consultant runs. This is both the responsibility of the advisor and the client. The Financial Consultant is accountable for offering worth for the costs.

Some Ideas on Clark Wealth Partners You Need To Know

Planning A company strategy is vital to the success of your organization. You need it to understand where you're going, just how you're getting there, and what to do if there are bumps in the road. A great economic advisor can put with each other a thorough plan to assist you run your service more effectively and get ready for abnormalities that arise.

Lowered Stress As a company owner, you have great deals of points to stress around. An excellent economic advisor can bring you peace of mind knowing that your finances are getting the attention they need and your money is being invested sensibly.

Sometimes business proprietors are so concentrated on the everyday grind that they lose view of the huge picture, which is to make a profit. An economic expert will look at the overall state of your funds without obtaining emotions entailed.

The Best Strategy To Use For Clark Wealth Partners

There are many pros and cons to think about when employing an economic advisor. Advisors offer customized methods customized to specific goals, potentially leading to much better economic end results.

The cost of employing a monetary expert can be substantial, with fees that may impact general returns. Financial planning can be overwhelming. We suggest talking with a monetary consultant. This complimentary device will certainly match you with vetted consultants that serve your area. Right here's exactly how it functions:Respond to a couple of simple concerns, so we can discover a match.

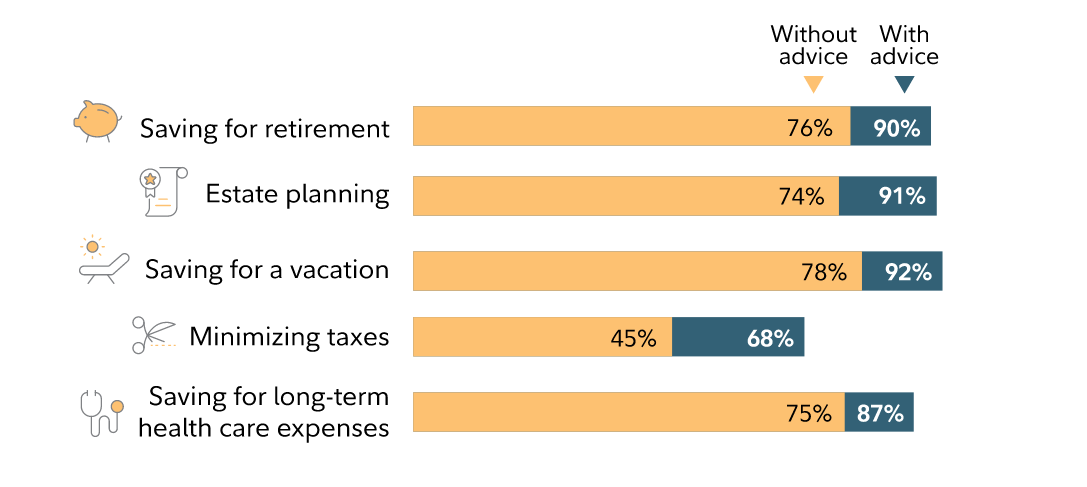

It just takes a few mins. Look into the experts' accounts, have an introductory phone call on the phone or introduction personally, and choose who to collaborate with. Discover Your Expert People turn to financial advisors for a myriad of factors. The possible benefits of working with a consultant include the experience and expertise they use, the individualized advice they can provide and the lasting self-control they can inject.

Our Clark Wealth Partners Statements

Advisors are experienced experts that remain updated on market patterns, financial investment strategies and monetary guidelines. This knowledge enables them to supply understandings that might not be easily noticeable to the average person - https://jet-links.com/Clark-Wealth-Partners_389318.html. Their knowledge can aid you navigate intricate monetary scenarios, make notified choices and potentially exceed what you would complete by yourselfReport this wiki page